A Third Of Russell 3000 Energy Companies Trade Below Book Value

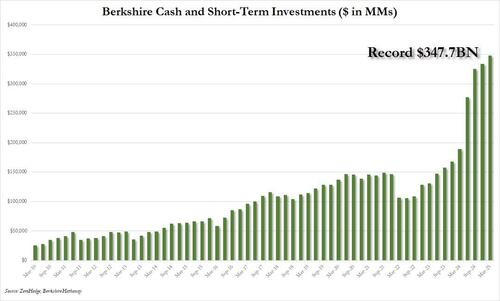

Looking at Berkshire’s mindblowing $350 billion cash stash…

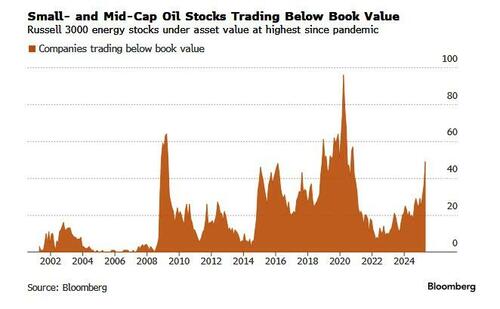

… one would think that there is nothing in the market that a value investor would find attractive. One would be wrong: almost half of all mid- and small-cap oil and gas stocks in the US are now trading below their book values. That’s the highest level since the pandemic. And according to Bloomberg, it’s a gift for value investors worshiping the gospel of Warren Buffett and his mentor Ben Graham, who referred to these kinds of opportunities as “cigar butts.”

“We’re going to take advantage of a lot of suckers,” said Cole Smead, CEO of Smead Capital Management, who has been buying additional oil and gas stocks that are trading well below book.

Energy has been the second-worst performing sector in the S&P 500 in Q2, losing roughly 10% since President Donald Trump’s April 2 tariff announcement, as oil prices tumble due to fears of global trade wars sparking economic slowdowns and OPEC member countries boosting production to increase supply. Two weeks ago, West Texas Intermediate crude fell to around $55 a barrel, a level it touched in April and before that February 2021. It has rebounded only modestly since then and remains down about 15% for the year.

Today, shares of oil and gas companies such as Murphy Oil, Crescent Energy and Noble Corp., are trading for less than what the assets on their books are worth. That’s the classic definition of value investing, where the stock is priced at less than what the business would be worth if it was stripped and sold for parts.

At this point, 33% of Russell 3000 energy stocks are trading below their book values. The figure rose as high as 40% late last week, before the US and China agreed to a 90-day trade truce, which gave a slight boost to oil prices and energy stocks. The last time this happened, it preceded off a two-year run in 2021 and 2022 when energy trounced the market and was the top-performing sector.

A similar proportion of large- and small- Canadian oil and gas stocks have also fallen into the same range, Bloomberg calcualtes.

Smead, who is invested on both sides of the border, thinks the stocks are undervalued and poised to at least return to book value, and likely more. “I don’t need to have a rosy picture” for the energy outlook to make money trading energy stocks, Smead said.

Smead isn’t alone in buying energy names cheap. A handful of cash rich oil and gas companies have indicated they’ll repurchase their stock if it has sold off sharply. Cenovus Energy bought back C$62 million ($44 million) of its own shares in the first quarter and has nearly tripled that to C$178 million in the second quarter so far.

“The smartest capital allocation today is to repurchase shares” rather than paying down debt, Diamondback Energy CEO Travis Stice said on a May 6 conference call. “Buybacks are the right thing at these levels” as crude prices have slipped, Stice said, adding that he expects the Texas-based oil producer to increase its stock repurchase program.

Not everyone will be able to take advantage of their cheaper stock price as they don’t have the available cash. Chevron , for instance, said it will cut buybacks in the second quarter following the drop in crude. It’s bigger, and higher quality peer, Exxon, however, continues to repurchase its stock with clockwork regularity as it print money quarter after quarter.

Then there is also a debate about how best to value oil and gas producers. BMO Capital Markets analyst Jeremy McCrea says book value isn’t a useful measurement for the energy sector since it can change quickly and dramatically with commodity prices. He prefers cash flow, Ebitda and reserve values, but says the stocks still are cheap based on those metrics.

“Typically, the best times to invest in the energy sector are when it feels the most uncomfortable,” McCrea said. “And it’s pretty uncomfortable right now just given this uncertainty. That’s historically some of the better times to come into the market.”

Tyler Durden Mon, 05/19/2025 – 17:20

Source: https://freedombunker.com/2025/05/19/a-third-of-russell-3000-energy-companies-trade-below-book-value/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.