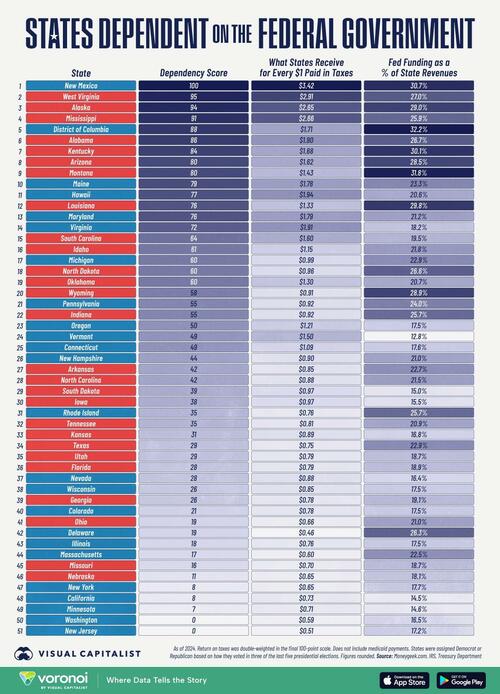

New Mexico Is The Most-Dependent State On The Federal Govt, New Jersey The Least

How reliant is your state on Uncle Sam’s wallet?

Every year, billions in federal tax dollars are redistributed to the 50 states and the District of Columbia through grants, contracts, and benefit programs.

Visual Capitalist’s Pallavi Rao ranks the states to see who benefits the most from the flows so readers can see the fiscal winners and losers at a glance.

Data for this visualization comes from MoneyGeek, which uses Census Bureau and Bureau of Economic Analysis figures.

Their dependency score blends two metrics: the state’s return‐on‐taxes ratio and the share of state revenues coming from federal sources.

Return on taxes measures how much state residents—including businesses—receive in federal payments for every $1 paid in tax to the federal government.

Return on taxes measures how much state residents—including businesses—receive in federal payments for every $1 paid in tax to the federal government.

Importantly, this data does not include Medicaid payments.

Finally, a state’s political affiliation is based on its voting history in the past five presidential elections.

Ranked: States That Need the Federal Government the Most

New Mexico tops the 2024 list for states most dependent on the federal government, with a perfect score of 100.

Its residents receive $3.42 for every tax dollar they send to Washington, while the state covers nearly a third of its budget with federal funds.

| Rank | State | Political Affiliation | Dependency Score | Return on Taxes | % of State Revenues From Federal Funding |

|---|---|---|---|---|---|

| 1 | New Mexico | Blue | 100 | $3.42 | 30.7% |

| 2 | West Virginia | Red | 95 | $2.91 | 27.0% |

| 3 | Alaska | Red | 94 | $2.65 | 29.0% |

| 4 | Mississippi | Red | 91 | $2.66 | 25.9% |

| 5 | District of Columbia | Blue | 88 | $1.71 | 32.2% |

| 6 | Alabama | Red | 86 | $1.90 | 26.7% |

| 7 | Kentucky | Red | 84 | $1.68 | 30.1% |

| 8 | Arizona | Red | 80 | $1.62 | 28.5% |

| 9 | Montana | Red | 80 | $1.43 | 31.8% |

| 10 | Maine | Blue | 79 | $1.78 | 23.3% |

| 11 | Hawaii | Blue | 77 | $1.94 | 20.6% |

| 12 | Louisiana | Red | 76 | $1.33 | 29.8% |

| 13 | Maryland | Blue | 76 | $1.79 | 21.2% |

| 14 | Virginia | Blue | 72 | $1.91 | 18.2% |

| 15 | South Carolina | Red | 64 | $1.60 | 19.5% |

| 16 | Idaho | Red | 61 | $1.15 | 21.8% |

| 17 | Michigan | Blue | 60 | $0.99 | 22.9% |

| 18 | North Dakota | Red | 60 | $0.96 | 26.6% |

| 19 | Oklahoma | Red | 60 | $1.30 | 20.7% |

| 20 | Wyoming | Red | 58 | $0.91 | 28.9% |

| 21 | Pennsylvania | Blue | 55 | $0.92 | 24.0% |

| 22 | Indiana | Red | 55 | $0.92 | 25.7% |

| 23 | Oregon | Blue | 50 | $1.21 | 17.5% |

| 24 | Vermont | Blue | 49 | $1.50 | 12.8% |

| 25 | Connecticut | Blue | 49 | $1.09 | 17.6% |

| 26 | New Hampshire | Blue | 44 | $0.90 | 21.0% |

| 27 | Arkansas | Red | 42 | $0.85 | 22.7% |

| 28 | North Carolina | Red | 42 | $0.88 | 21.5% |

| 29 | South Dakota | Red | 39 | $0.97 | 15.0% |

| 30 | Iowa | Red | 38 | $0.97 | 15.5% |

| 31 | Rhode Island | Blue | 35 | $0.76 | 25.7% |

| 32 | Tennessee | Red | 35 | $0.81 | 20.9% |

| 33 | Kansas | Red | 31 | $0.89 | 16.8% |

| 34 | Texas | Red | 29 | $0.75 | 22.9% |

| 35 | Utah | Red | 29 | $0.79 | 18.7% |

| 36 | Florida | Red | 28 | $0.79 | 18.9% |

| 37 | Nevada | Blue | 28 | $0.88 | 16.4% |

| 38 | Wisconsin | Blue | 26 | $0.85 | 17.5% |

| 39 | Georgia | Red | 26 | $0.78 | 19.1% |

| 40 | Colorado | Blue | 21 | $0.78 | 17.5% |

| 41 | Ohio | Red | 19 | $0.66 | 21.0% |

| 42 | Delaware | Blue | 19 | $0.46 | 26.3% |

| 43 | Illinois | Blue | 18 | $0.76 | 17.5% |

| 44 | Massachusetts | Blue | 17 | $0.60 | 22.5% |

| 45 | Missouri | Red | 16 | $0.70 | 18.7% |

| 46 | Nebraska | Red | 11 | $0.65 | 18.1% |

| 47 | New York | Blue | 8 | $0.65 | 17.7% |

| 48 | California | Blue | 8 | $0.73 | 14.5% |

| 49 | Minnesota | Blue | 7 | $0.71 | 14.6% |

| 50 | Washington | Blue | 0 | $0.59 | 16.5% |

| 51 | New Jersey | Blue | 0 | $0.51 | 17.2% |

Note: The tax return ratio was given double-weight in the final score.

West Virginia, Alaska, and Mississippi follow closely, each exceeding $2.60 in returns and relying on federal transfers for more than a quarter of state revenues.

The outlier is the District of Columbia: despite a lower tax return multiple ($1.71), 32% of its revenue comes from the federal government. This is unsurprising given its role as the nation’s administrative hub.

Federal Dependency: Red vs. Blue States

MoneyGeek’s ranking reveals a partisan tilt: seven of the states with the top 10 dependency scores are red, including conservative strongholds such as Alabama, Kentucky, and Montana.

Meanwhile, 11 of the 20 net tax recipient states have voted Republican in at least three of the past five presidential elections.

Yet political color is not destiny. Deep-blue New Mexico and D.C. also sit near the top.

MoneyGeek’s analysis points to economic structure rather than ideology: energy extraction, military installations, and a high share of retirees often correlate with greater federal inflows.

The Big List of Donor States

At the opposite end, New Jersey and Washington score zero, receiving roughly half a dollar back for every dollar paid their residents pay in taxes.

California, New York, and Minnesota also run sizable “deficits,” each collecting less than 75 cents on the dollar.

These donor states tend to have large, diversified economies and higher-than-average household incomes, boosting tax receipts while limiting eligibility for certain federal aid programs.

Their contributions effectively subsidize public services elsewhere—fueling perennial debates over tax fairness and redistribution.

For more insights, cross-reference this post with Visualizing $29 Trillion Economy by State on Voronoi, the new app from Visual Capitalist.

Tyler Durden Tue, 07/01/2025 – 20:30

Source: https://freedombunker.com/2025/07/01/new-mexico-is-the-most-dependent-state-on-the-federal-govt-new-jersey-the-least/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.